Is Qqq Etf Actively Managed

The Invesco NASDAQ-100 Growth Leaders Portfolio NASDAQ. It doesnt depend on a single person for the performance.

The QQQ ETF has an expense ratio of just 02 which is another reason why it is popular among competing products.

Is qqq etf actively managed. The Case for Actively Managed ETFs in 2021 Tom Lydon February 24 2021 Active managers have taken some lumps in recent years but many market observers believe that active opportunities will shine. QQQ on the other hand is a passively managed fund. It just tracks the index.

Actively managed ETFs have only been offered in the US. An actively managed ETF does have a benchmark index but managers may alter sector allocations market-time trades or shift from the index constituents. Consider 3 Actively-Managed ETFs Ben Hernandez April 20 2021 Blockchain cannabis and dividend yields are a few of the top-performing sectors in the actively-managed space from ETF.

Click here to see how QQQ has helped power portfolios for over 20 years. Investing in exchange-traded funds. The actively-managed fund holds options and collateral.

An actively managed ETF does have a benchmark index but managers may alter sector allocations market-time trades or shift from the index constituents. The first active ETF was Bear Stearns Current Yield ETF. Theres also the Invesco Nasdaq 100 Growth Leaders Portfolio QQQG an actively-managed ETF holding the 25 stocks in the QQQ that have.

QDEC Factset Analytics Insight QDEC uses. Invesco QQQ is an exchange-traded fund that tracks the Nasdaq-100 Index. Currently actively managed ETFs are fully transparent publishing their current securities portfolios on their.

Since ordinary brokerage commissions apply for each ETF buy and sell transaction frequent trading activity may increase the cost of ETFs. Shares are not actively managed. Making them less expensive than their actively managed counterparts.

ETFs also have lower fees and expenses than mutual funds particularly mutual funds that are actively managed. This is a match up of two cocky ETFs with lots of chatter surrounding them. In fact the QQQ ETF has a companion ETF the ProShares Short QQQ that exists for just that purpose.

Most ETFs are index funds but some ETFs do have active management. 27 rows Most ETFs are structured as passively managed funds which means they. The hybrid was actively managed ETFs.

Todays arm wrestle is between the Invesco NASDAQ 100 ETF QQQ against the ARK Innovation ETF ARKK. An actively managed ETF is a form of exchange-traded fund that has a manager or team making decisions on the underlying portfolio allocation otherwise not adhering to a passive investment strategy. QQQ is index linked whereas ARKK is actively managed Both ETFs own some of the same stocks like Tesla ROKU and Square Ron.

QDEC aims for specific buffered losses and capped gains on QQQ ETF over a specific holdings period. QQQG is an actively managed fund QQQ is passive and unique in that focuses on the 25 Nasdaq-100 companies deemed to have the best growth. Access some of todays most innovative companies all in one exchange-traded fund ETF.

The Index includes the 100 largest non-financial companies listed on the Nasdaq based on market cap. When it launched 20 years ago the Invesco QQQ ETF QQQ was a pioneer in simplifying how investors gained access to companies within the NASDAQ-100 Index. This is an actively managed ETF offering exposure to companies in the Nasdaq 100 Index that have screened based on fundamental factors including relative valuations such as priceearnings price.

Performance of actively managed funds are very dependent on the portfolio manager unless the person succeeding her is as good as her I dont think ARKK is suitable for long term investing. Unlike ETFs actively managed mutual funds have the ability react to market changes and the potential to outperform a stated benchmark. Two of the most popular ETFs are the Invesco QQQ ETF and the.

Mohnish Pabrai 6 5x Return On Deep Value Turkish Stock 2020 Letter In 2021 Lettering Investing Value Investing

Mohnish Pabrai 6 5x Return On Deep Value Turkish Stock 2020 Letter In 2021 Lettering Investing Value Investing

Etfs Will Keep Getting More Active J P Morgan Says Marketwatch Investing Cash Management Active

Etfs Will Keep Getting More Active J P Morgan Says Marketwatch Investing Cash Management Active

Etfs Will Keep Getting More Active J P Morgan Says Marketwatch Cash Management Investing Active

Etfs Will Keep Getting More Active J P Morgan Says Marketwatch Cash Management Investing Active

Looking For Performance Consider 3 Actively Managed Etfs Nasdaq

Looking For Performance Consider 3 Actively Managed Etfs Nasdaq

Friday Was Yet Another Example Of Stocks Shrugging Off Great Earnings Results As The Tech Heavy Nasdaq Was Flat Despite Earnin Nasdaq Business Process Earnings

Friday Was Yet Another Example Of Stocks Shrugging Off Great Earnings Results As The Tech Heavy Nasdaq Was Flat Despite Earnin Nasdaq Business Process Earnings

Sector Index Trading Using Etfs Index Stock Exchange Investing In Stocks

Sector Index Trading Using Etfs Index Stock Exchange Investing In Stocks

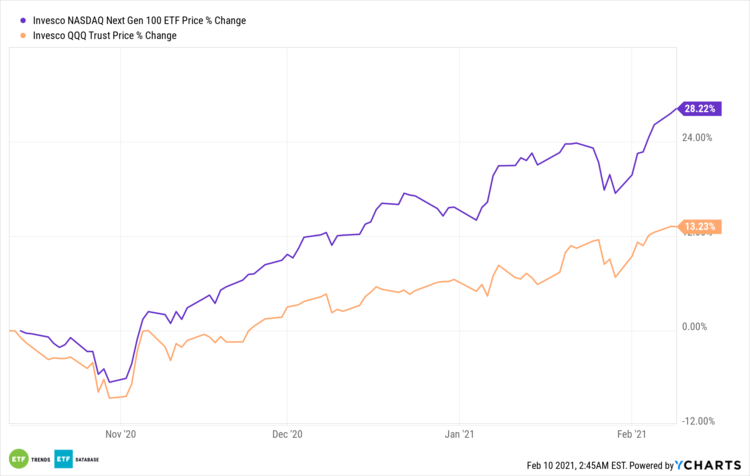

What S Hotter Than The Qqq Etf The Qqqj Etf

What S Hotter Than The Qqq Etf The Qqqj Etf

Looking For Performance Consider 3 Actively Managed Etfs Nasdaq

Looking For Performance Consider 3 Actively Managed Etfs Nasdaq

Etfs Holding Shop Shopify Inc Etf Channel Shopify Information Technology Services Customer Relationships

Etfs Holding Shop Shopify Inc Etf Channel Shopify Information Technology Services Customer Relationships

Inpx 0 48 Cents A Super Stock Ripe For A Come Back Nasdaq Stock Analysis Stock Prices

Inpx 0 48 Cents A Super Stock Ripe For A Come Back Nasdaq Stock Analysis Stock Prices

Mutual Fund To Etf Converter In 2021 Mutuals Funds Income Investing Investing

Mutual Fund To Etf Converter In 2021 Mutuals Funds Income Investing Investing

The Stockmarket Is Now Run By Computers Algorithms And Passive Managers Dow Jones Index Algorithm Stock Market

The Stockmarket Is Now Run By Computers Algorithms And Passive Managers Dow Jones Index Algorithm Stock Market

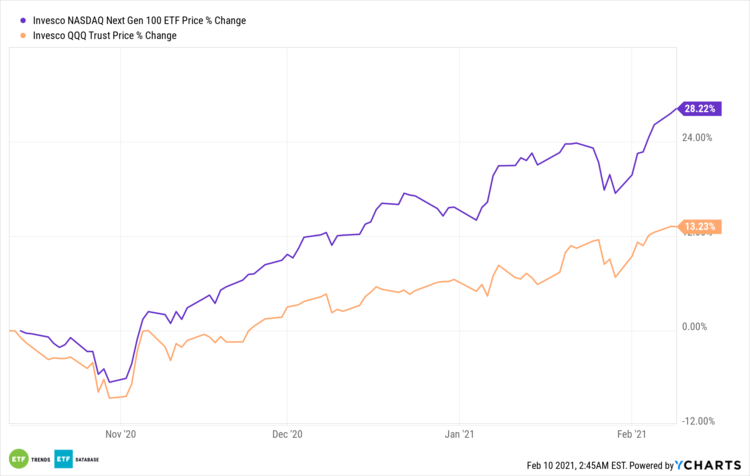

3 Actively Managed Ishares Etfs Are Flourishing Nasdaq

3 Actively Managed Ishares Etfs Are Flourishing Nasdaq

What Can Actively Managed Cannabis Etfs Do For You

What Can Actively Managed Cannabis Etfs Do For You

Inpx Bullish Indicators For Inpixion Nasdaq Stock Analysis Moving Average

Inpx Bullish Indicators For Inpixion Nasdaq Stock Analysis Moving Average

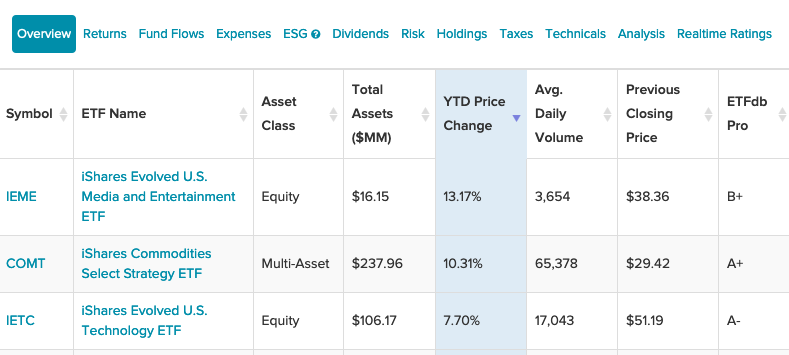

Types Of Etfs Investing Value Investing Finance

Types Of Etfs Investing Value Investing Finance

Post a Comment for "Is Qqq Etf Actively Managed"